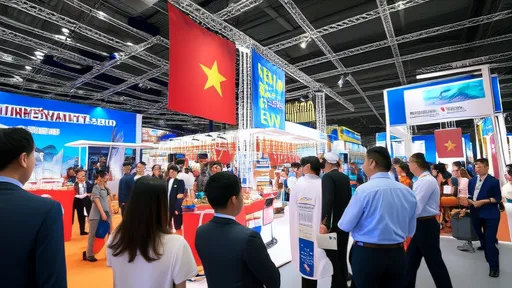

In the heart of Southeast Asia, Vietnam is quietly orchestrating one of the most remarkable economic transformations of our time. According to recent analyses by HSBC, the nation's aggressive push toward digitalization is not merely a technological upgrade but a fundamental reshaping of its economic DNA. While global supply chains faltered and economies worldwide grappled with uncertainty, Vietnam demonstrated a resilience that caught many observers by surprise. This resilience, HSBC notes, is deeply intertwined with the country's digital ambitions, creating a virtuous cycle where technological adoption fuels economic stability, which in turn enables further digital investment.

The story begins not in boardrooms or government offices, but in the bustling streets of Hanoi and Ho Chi Minh City, where QR code payments have become as commonplace as motorbikes. What started as a convenience for urban consumers has evolved into a nationwide financial revolution. The State Bank of Vietnam reports that digital transactions grew by an astonishing 85% in the past year alone, with mobile payment value increasing nearly threefold. This isn't just about replacing cash—it's about creating an entirely new financial ecosystem that connects previously unbanked populations to the formal economy. The implications are profound: small businesses can access credit, farmers can receive payments directly, and households can participate in e-commerce in ways that were unimaginable just five years ago.

Behind this consumer-facing transformation lies a deeper, more systematic overhaul of Vietnam's industrial backbone. Manufacturing, which accounts for nearly 25% of GDP, is undergoing what industry insiders call "Industry 4.0 with Vietnamese characteristics." Factories that once competed on cheap labor alone are now integrating IoT sensors, AI-powered quality control, and blockchain-enabled supply chain management. The results speak for themselves: despite global disruptions, Vietnam's manufacturing output grew by 7.2% last quarter, while export values reached record highs. This isn't accidental—it's the product of deliberate policy and private sector innovation working in concert.

The government's role in this transformation cannot be overstated. When the Prime Minister launched the National Digital Transformation Program in 2020, many viewed it as another bureaucratic initiative. Instead, it has become the driving force behind Vietnam's technological leap. The program established clear targets: digital economy to contribute 30% to GDP by 2030, broadband internet covering all households, and 100% of public services available online. What's remarkable isn't the ambition of these goals, but the speed of their implementation. Already, over 70% of population has regular internet access, and more than 2,000 public services have been digitized. The bureaucracy that once required multiple in-person visits now handles many procedures through a single digital portal.

Foreign investment has played a crucial role in accelerating this transformation. While many know Vietnam as a manufacturing hub for electronics and textiles, it's increasingly becoming a destination for tech investment. Samsung alone has poured over $17 billion into Vietnam, creating not just assembly lines but R&D centers that employ thousands of Vietnamese engineers. Intel's largest semiconductor packaging facility globally operates in Ho Chi Minh City, while Google recently announced plans to open its first data center in Southeast Asia—in Vietnam. These investments bring more than capital; they transfer knowledge, create high-skilled jobs, and integrate Vietnam into global tech ecosystems.

Perhaps the most telling indicator of Vietnam's digital maturity is the emergence of homegrown tech unicorns. Companies like VNG, Momo, and Tiki have evolved from startups to industry leaders, developing solutions tailored to local needs while competing with global giants. MoMo, Vietnam's leading e-wallet, now processes more transactions than many regional banks, serving over 30 million users. What's particularly interesting is how these companies are expanding beyond their initial domains—MoMo now offers insurance and investment products, while VNG has moved from gaming to cloud services. This evolution suggests a digital ecosystem reaching critical mass, where success in one sector fuels innovation in others.

The human dimension of this transformation is equally compelling. Vietnam's young population—over 70% under age 35—has embraced technology not as a novelty but as an essential tool for advancement. University enrollment in STEM fields has doubled in the past decade, while coding bootcamps and digital skills training have become growth industries in their own right. This isn't just about creating programmers; it's about building a workforce capable of thriving in a digital economy. The results are visible in everything from agricultural apps that help farmers optimize crop yields to telemedicine platforms that connect rural patients with urban specialists.

Yet challenges remain, and they're not insignificant. The digital divide between urban and rural areas, while narrowing, still persists. Cybersecurity concerns have grown alongside digital adoption, with the National Cyber Security Center reporting a 40% increase in attacks last year. Regulatory frameworks sometimes struggle to keep pace with technological change, creating uncertainty for investors. And perhaps most fundamentally, there's the question of whether this rapid transformation can be sustained without creating new forms of inequality or environmental damage.

Looking ahead, Vietnam's digital journey appears poised for its next chapter. The government's recent approval of a strategy for AI development by 2030 signals that the country isn't resting on its laurels. Meanwhile, the ongoing US-China trade tensions have positioned Vietnam as an attractive alternative for companies seeking to diversify their supply chains. But the real test will be whether Vietnam can move from adopting technology to creating it—from implementing solutions developed elsewhere to pioneering innovations that address global challenges.

What makes Vietnam's case particularly instructive for other developing economies is its holistic approach. This isn't just about building tech parks or passing digital laws—it's about creating an entire ecosystem where infrastructure, education, regulation, and entrepreneurship reinforce each other. The results, as HSBC's analysis suggests, speak for themselves: an economy that grew at nearly 8% last year despite global headwinds, with digital sectors among the fastest-growing components. In an era of uncertainty, Vietnam's digital transformation offers a compelling case study in how technological adoption, when combined with sound economic policies and social readiness, can build not just efficiency but genuine resilience.

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025