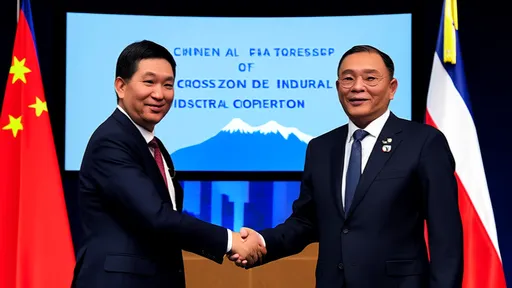

In a landmark move that signals growing international cooperation in sustainable finance, Beijing's Financial Street and Casablanca Finance City have signed a comprehensive memorandum of understanding to deepen their collaboration in green financial initiatives. The agreement, finalized during high-level talks between Chinese and Moroccan financial authorities, establishes a framework for knowledge sharing, joint research, and market development in environmentally conscious investment practices.

The signing ceremony took place against the backdrop of increasing global pressure for financial systems to address climate change and environmental degradation. Representatives from both financial hubs emphasized the strategic importance of this partnership in bridging Asian and African markets while advancing the United Nations Sustainable Development Goals. This collaboration represents one of the most significant cross-continental partnerships specifically focused on green finance infrastructure development, according to financial analysts observing the agreement.

Beijing Financial Street, often described as China's Wall Street, has been aggressively positioning itself as a global leader in sustainable finance regulation and innovation. Over the past decade, the district has hosted numerous international financial institutions and regulatory bodies that have pioneered green bond standards and environmental risk assessment frameworks. The Chinese government has identified green finance as a strategic priority in its recent five-year plans, with Financial Street serving as the primary testing ground for new policies and financial instruments.

Meanwhile, Casablanca Finance City has emerged as Morocco's flagship financial center and a gateway to African markets. The Moroccan government has invested heavily in establishing the city as a sustainable finance hub for Francophone Africa, leveraging the country's ambitious renewable energy programs and strategic position between European and African economies. Morocco's substantial investments in solar and wind energy infrastructure have provided practical experience in financing large-scale green projects, making the country an ideal partner for Chinese institutions seeking to understand African market dynamics.

The memorandum outlines several key areas of cooperation, including the development of standardized green finance taxonomies that can be applied across both markets. Financial regulators from both centers will work together to create harmonized definitions of what constitutes green assets, addressing one of the major challenges in global sustainable finance – the lack of consistent classification systems. This alignment is expected to reduce greenwashing and provide clearer guidance for investors seeking authentic environmentally friendly opportunities.

Another significant component of the agreement focuses on capacity building and professional training. Exchange programs will be established for financial professionals, regulators, and policymakers to share expertise in green financial product development, environmental risk management, and sustainable investment strategies. These knowledge transfer initiatives aim to bridge the technical expertise gap that often hinders the development of robust green finance markets in emerging economies, particularly in regions most vulnerable to climate change impacts.

The partnership will also facilitate cross-border green investment flows by creating dedicated channels for funding environmentally sustainable projects in both regions. Chinese investors gain improved access to renewable energy and climate resilience projects across Africa, while Moroccan and other African investors can more easily participate in China's rapidly expanding green technology sector. This aspect of the collaboration addresses the critical funding gap that has limited the scale of green infrastructure development in many developing nations.

Research and innovation form another pillar of the newly established relationship. Joint research centers will be established in both financial districts to study emerging trends in sustainable finance, develop new financial instruments for climate adaptation, and analyze the effectiveness of different policy approaches to promoting green investment. The research outcomes are expected to contribute significantly to global knowledge about what works in green finance regulation and market development.

The timing of this agreement reflects strategic considerations from both parties. China has been actively seeking to expand its influence in global financial governance, particularly in areas where Western institutions have traditionally dominated. By positioning itself as a leader in green finance – an area of growing international consensus – Beijing aims to enhance its soft power and shape emerging global standards. Meanwhile, Morocco sees the partnership as an opportunity to attract Chinese investment in its domestic green transition while establishing Casablanca Finance City as the continent's premier center for sustainable finance expertise.

Industry reactions to the memorandum have been largely positive, though some observers have raised questions about implementation challenges. Differences in regulatory frameworks, business cultures, and market maturity could present obstacles to seamless cooperation. Additionally, some environmental advocates have expressed concerns about ensuring that the partnership maintains high environmental standards and avoids financing projects with questionable sustainability credentials under the vague banner of "green finance."

Despite these potential challenges, the collaboration between Beijing Financial Street and Casablanca Finance City represents a significant step forward in the globalization of green finance. As climate change continues to demand urgent action from financial systems worldwide, such cross-border partnerships may become increasingly common. The success or failure of this particular initiative will likely influence how other financial centers approach international cooperation on sustainable finance matters.

The memorandum comes at a time when global green finance markets are experiencing rapid growth but remain fragmented along regional lines. According to recent estimates, the global green bond market alone has surpassed one trillion dollars in cumulative issuance, with China representing the second-largest source of green bonds after the European Union. However, the lack of coordination between different green finance hubs has limited the efficiency and impact of these markets. The Beijing-Casablanca partnership attempts to address this fragmentation by creating direct links between major financial centers in Asia and Africa.

Looking forward, the success of this collaboration will depend on several factors, including sustained political support from both governments, the commitment of private financial institutions to actively participate in joint initiatives, and the ability to develop practical cooperation mechanisms that deliver tangible benefits to both parties. If successful, the partnership could serve as a model for similar arrangements between other financial centers seeking to promote sustainable development through coordinated financial market policies and practices.

The evolving relationship between Chinese and African financial markets has broader implications for global economic governance. As developing countries increasingly collaborate on financial standards and market development, traditional Western-dominated financial institutions may need to adapt to a more multipolar system. The green finance sector, being relatively new and still taking shape, presents an opportunity for emerging economies to exert greater influence over the rules and norms that will govern sustainable investment for decades to come.

Environmental campaigners will be watching closely to ensure that the partnership translates into genuine environmental benefits rather than simply creating new channels for business-as-usual investment dressed in green clothing. The credibility of both financial centers, and indeed the entire green finance movement, depends on demonstrating that specialized financial instruments and markets can deliver measurable improvements in environmental outcomes.

As implementation of the memorandum begins in the coming months, attention will turn to the specific projects and initiatives that emerge from this collaboration. The first joint working groups are expected to convene before the end of the year, with initial focus areas likely including the development of cross-border green investment funds, joint certification standards for green financial products, and research on climate risk assessment methodologies suitable for both Chinese and African market conditions.

The Beijing Financial Street-Casablanca Finance City partnership represents more than just a bilateral agreement – it signals a potential shift in how international financial cooperation addresses global environmental challenges. By linking financial centers across continents with shared sustainable development objectives, such initiatives could help accelerate the transition to a greener global economy while creating new patterns of South-South cooperation in financial governance.

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025

By /Nov 4, 2025